Multiple Choice

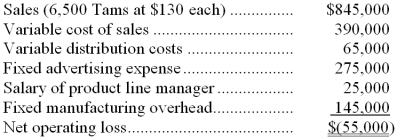

The Clemson Company reported the following results last year for the manufacture and sale of one of its products known as a Tam.  Clemson Company is trying to determine whether or not to discontinue the manufacture and sale of Tams. The operating results reported above for last year are expected to continue in the foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the costs of production facilities and equipment that the Tam product shares with other products produced by Clemson. If the Tax product were dropped, there would be no change in the fixed manufacturing costs of the company.

Clemson Company is trying to determine whether or not to discontinue the manufacture and sale of Tams. The operating results reported above for last year are expected to continue in the foreseeable future if the product is not dropped. The fixed manufacturing overhead represents the costs of production facilities and equipment that the Tam product shares with other products produced by Clemson. If the Tax product were dropped, there would be no change in the fixed manufacturing costs of the company.

-Assume that discontinuing the Tam product would result in a $120,000 increase in the contribution margin of other product lines. How many Tams would have to be sold next year for the company to be as well off as if it just dropped the line and enjoyed the increase in contribution margin from other products?

A) 5,000 units

B) 6,000 units

C) 6,500 units

D) 7,000 units

Correct Answer:

Verified

Correct Answer:

Verified

Q73: The following are the Wyeth Company's unit

Q74: Veron Corporation purchases potatoes from farmers. The

Q75: Rackett Corporation is considering two alternatives that

Q76: Julison Company produces a single product. The

Q77: Tjelmeland Corporation is considering dropping product S85U.

Q77: Cranston Corporation makes four products in a

Q80: Chrisjohn Beet Processors, Inc., processes sugar beets

Q81: Two alternatives, code-named X and Y, are

Q82: Two alternatives, code-named X and Y, are

Q83: Corado Corporation has in stock 77,000 kilograms