Essay

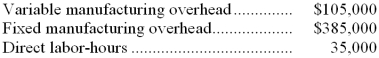

Zaccagnino Corporation makes a range of products. The company's predetermined overhead rate is $14 per direct labor-hour, which was calculated using the following budgeted data:

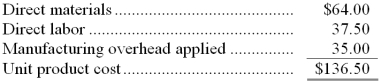

Management is considering a special order for 300 units of product D03C at $119 each. The normal selling price of product D03C is $157 and the unit product cost is determined as follows:

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

Required:

If the special order were accepted, what would be the impact on the company's overall profit?

Correct Answer:

Verified

Direct materials, direct labor, and vari...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Dodge Company makes two products from a

Q34: Kava Inc. manufactures industrial components. One of

Q35: Gloster Company makes three products in a

Q36: Janeiro Skate, Inc. currently manufactures the wheels

Q38: Fouch Company makes 30,000 units per year

Q39: In a plant operating at capacity:<br>A) every

Q40: Mccubbin Corporation is considering two alternatives: A

Q41: Outram Corporation is presently making part I14

Q42: Nowak Corporation is a specialty component manufacturer

Q105: Cranston Corporation makes four products in a