Multiple Choice

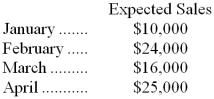

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a cash budget for March, the total cash receipts would be:

A) $17,800

B) $8,200

C) $20,200

D) $16,000

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Pardise Company plans the following beginning

Q16: Gokey Inc. bases its manufacturing overhead budget

Q17: The following are budgeted data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3790/.jpg"

Q18: The Stacy Company makes and sells a

Q21: Budgets are used for planning rather than

Q22: Davie Corporation is preparing its Manufacturing Overhead

Q23: Crose Inc. is working on its cash

Q24: The excess or deficiency of cash available

Q25: Which of the following is not a

Q34: The Adams Corporation, a merchandising firm, has