Multiple Choice

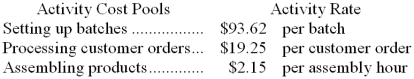

Pauls Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:

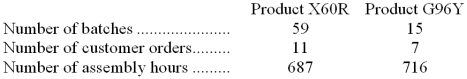

Data concerning two products appear below:

How much overhead cost would be assigned to Product X60R using the activity-based costing system?

A) $5,523.58

B) $87,070.14

C) $115.02

D) $7,212.38

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Stoudmire Corporation uses an activity-based costing system

Q23: The clerical activity associated with processing purchase

Q24: Finkel & Robbins PLC, a consulting firm,

Q25: The following data have been provided by

Q26: Fordham Florist specializes in large floral bouquets

Q28: The following data have been provided by

Q29: Kassabian Corporation uses an activity-based costing system

Q31: Sailer Corporation uses the following activity rates

Q32: Kraska Corporation has provided the following data

Q113: Testing a prototype of a new product