Multiple Choice

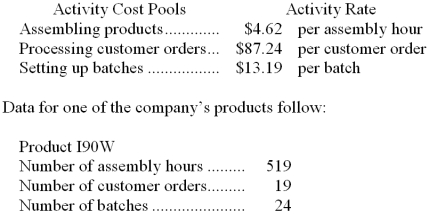

Suoboda Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:

How much overhead cost would be assigned to Product I90W using the activity-based costing system?

A) $316.56

B) $105.05

C) $4,371.90

D) $59,038.10

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Accola Company uses activity-based costing. The

Q10: Kleppe Corporation has provided the following data

Q11: Emmette Corporation uses an activity-based costing system

Q12: Daniele Corporation uses an activity-based costing system

Q13: Proudfoot Corporation uses the following activity rates

Q15: Lifsey Wedding Fantasy Company makes very elaborate

Q16: Morsell Corporation has provided the following data

Q17: Toma Nuptial Bakery makes very elaborate wedding

Q18: Viren Corporation has provided the following data

Q19: Duration drivers ordinarily require more effort to