Multiple Choice

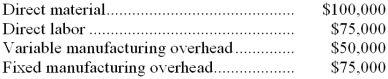

Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows:  Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-The contribution margin per unit would be:

A) $15.00

B) $11.00

C) $8.00

D) $6.00

Correct Answer:

Verified

Correct Answer:

Verified

Q114: A manufacturing company that produces a single

Q115: Under variable costing, product cost contains some

Q116: Neuman Company, which has only one product,

Q117: Erie Company manufactures a single product. Assume

Q118: Walsh Company produces a single product. Last

Q120: Schrick Inc. manufactures a variety of products.

Q121: The costing method that can be used

Q122: Dewiel Corporation manufactures a variety of products.

Q123: Schubert Corporation manufactures a variety of products.

Q124: Under the absorption costing method, a company