Multiple Choice

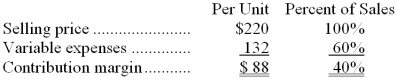

Hinsey Corporation produces and sells a single product. Data concerning the product appear below:  Fixed expenses are $300,000 per month. The company is currently selling 4,000 units per month. Consider each of the following questions independently.

Fixed expenses are $300,000 per month. The company is currently selling 4,000 units per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Hinsey Corporation. Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $37,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 200 units. What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $34,800

B) increase of $8,400

C) decrease of $65,600

D) increase of $360,400

Correct Answer:

Verified

Correct Answer:

Verified

Q119: Hilty Corporation produces and sells two products.

Q120: Last year, Twins Company reported $750,000 in

Q121: The April contribution format income statement of

Q122: Green Company's variable expenses are 75% of

Q123: Hooper Corporation produces and sells two models

Q125: Akerley, Inc., produces and sells a single

Q126: Rana Corporation produces and sells a single

Q127: Faust Corporation has provided its contribution format

Q128: Boening Enterprises, Inc., produces and sells a

Q129: Deavila Inc. produces and sells two products.