Essay

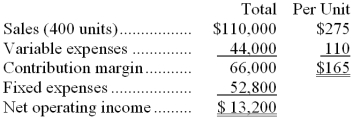

The following monthly data are available for the Challenger Company and its only product, Product SW:

Required:

a. Without resorting to calculations, what is the total contribution margin at the break-even point?

b. Management is contemplating the use of plastic gearing rather than metal gearing in Product SW. This change would reduce variable costs by $15. The company's marketing manager predicts that this would reduce the overall quality of the product and thus would result in a decline in sales to a level of 350 units per month. Should this change be made?

c. Assume that Challenger Company is currently selling 400 units of Product SW per month. Management wants to increase sales and feels this can be done by cutting the selling price by $25 per unit and increasing the advertising budget by $20,000 per month. Management believes that these actions will increase unit sales by 50%. Should these changes be made?

d. Assume that Challenger Company is currently selling 400 units of Product SW. Management wants to automate a portion of the production process for Product SW. The new equipment would reduce direct labor costs by $20 per unit but would result in a monthly rental cost for the new robotic equipment of $10,000. Management believes that the new equipment will increase the reliability of Product SW thus resulting in an increase in monthly sales of 12%. Should these changes be made?

Correct Answer:

Verified

a. The total contribution margin is $52,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: The following data concern two products sold

Q114: Speir Corporation's contribution format income statement for

Q115: At a break-even point of 400 units

Q116: Mitch Corporation's contribution margin ratio is 14%

Q117: Junsin Corporation's budget for next year appears

Q119: Hilty Corporation produces and sells two products.

Q120: Last year, Twins Company reported $750,000 in

Q121: The April contribution format income statement of

Q122: Green Company's variable expenses are 75% of

Q123: Hooper Corporation produces and sells two models