Multiple Choice

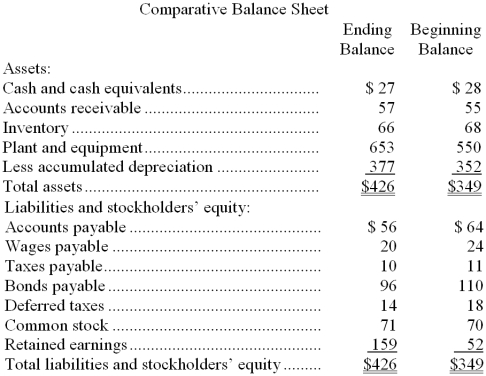

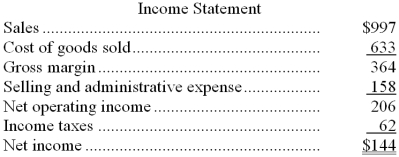

The most recent balance sheet and income statement of Mackinaw Corporation appear below:

Cash dividends were $37. The net cash provided by (used by) operations for the year was:

A) $8

B) $136

C) $206

D) $152

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q32: Balance sheet accounts for Hollis, Inc. contained

Q33: Last year Lawton Company reported sales of

Q34: Under the direct method of determining net

Q35: Under the direct method of determining the

Q36: During the year the balance in the

Q37: Carver Company's comparative balance sheet and income

Q38: Van Cleef Company's comparative balance sheet and

Q39: Comparative financial statements for Parr Company follow:

Q40: The changes in Tench Company's balance sheet

Q42: Van Cleef Company's comparative balance sheet and