Multiple Choice

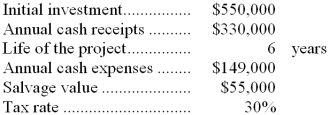

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

A) $27,500

B) $77,000

C) $33,000

D) $64,167

Correct Answer:

Verified

Correct Answer:

Verified

Q16: In a net present value analysis of

Q17: An investment of $180,000 made now will

Q18: Littau Inc. has provided the following data

Q19: Salomone Inc. has provided the following data

Q20: To determine the effect of income taxes

Q22: If a company is operating at a

Q23: In a plant expansion capital budgeting decision,

Q24: Eyring Industries has a truck purchased seven

Q25: Which of the following would decrease the

Q26: A company is considering purchasing an asset