Multiple Choice

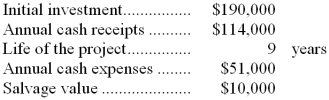

Littau Inc. has provided the following data concerning an investment project that has been proposed:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

-When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A) $0

B) $3,000

C) $10,000

D) $7,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Management is considering purchasing an asset for

Q7: A company anticipates a taxable cash receipt

Q8: Bauerkemper Inc. is considering a project that

Q9: If a company operates at a profit,

Q10: A company anticipates a taxable cash expense

Q12: Wable Inc. has provided the following data

Q13: Suppose a machine that costs $80,000 has

Q14: A company needs an increase in working

Q15: Demirjian Inc. is considering an investment project

Q16: In a net present value analysis of