Essay

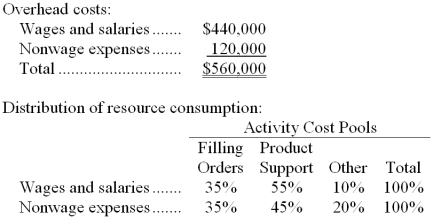

Goha Company, a wholesale distributor, uses activity-based costing for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

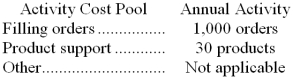

The amount of activity for the year is as follows:

Required:

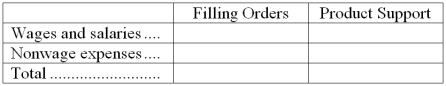

Compute the activity rates (i.e., cost per unit of activity) for the Filling Orders and Product Support activity cost pools by filling in the table below:

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Grodin Catering uses activity-based costing for its

Q3: Grodin Catering uses activity-based costing for its

Q4: If a cost object such as a

Q5: Eschbach Company is a wholesale distributor that

Q6: An action analysis report reconciles activity-based costing

Q8: Janz Painting paints the interiors and exteriors

Q9: Eschbach Company is a wholesale distributor that

Q10: Eschbach Company is a wholesale distributor that

Q11: If a cost object such as a

Q12: Hasleby Hardwood Floors installs oak and other