Multiple Choice

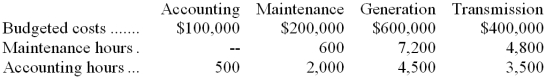

The Mohawk-Hudson Company is an electric utility which has two service departments, Accounting and Maintenance. It has two operating departments, Generation and Transmission. The company does not distinguish between fixed and variable service department costs. Maintenance Department costs are allocated on the basis of maintenance hours. Accounting Department costs are allocated to operating departments on the basis of accounting hours of service provided. Budgeted costs and other data for the coming year are as follows:  The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

-The amount of Maintenance Department cost allocated to the Accounting Department would be:

A) $0

B) $69,315

C) $75,000

D) $88,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Finkler Legal Services, LLC, uses the step-down

Q2: The direct method is used by Hoeffner

Q3: The direct method has the disadvantage that

Q6: Holmon Surgical Hospital uses the direct method

Q7: Quezaire Corporation, a manufacturer, uses the step-down

Q8: When would the direct method and the

Q9: If personnel department expenses are allocated on

Q10: Weisenborn Corporation uses the direct method to

Q11: Finkler Legal Services, LLC, uses the step-down

Q54: (Appendix 4B) The James Corporation has four