Essay

Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

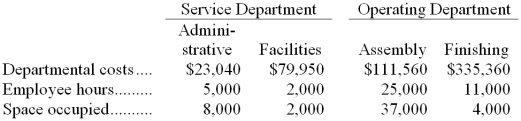

-Maclennan Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Administrative and Facilities, and two operating departments, Assembly and Finishing.

Administrative Department costs are allocated on the basis of employee hours and Facilities Department costs are allocated on the basis of space occupied.

Required:

Allocate the service department costs to the operating departments using the direct method.

Correct Answer:

Verified

Allocation rate for administrative costs...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: (Appendix 4B) The James Corporation has four

Q31: Reciprocal service department costs are:<br>A) allocated to

Q32: Wiedenheft Children's Clinic allocates service department costs

Q33: Parker Company has two service departments, cafeteria

Q34: Costillo Corporation has two service departments, Service

Q35: Hopp Corporation uses the direct method to

Q38: The Mohawk-Hudson Company is an electric utility

Q39: Aderholt Emergency Care Hospital uses the step-down

Q40: Franca Corporation has two service departments, Administrative

Q41: Goffinet Consultancy uses the direct method to