Multiple Choice

Table 29-5.

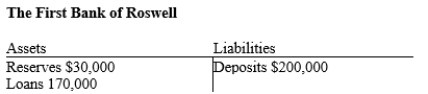

-Refer to Table 29-5. Suppose the bank faces a reserve requirement of 10 percent. Starting from the situation as depicted by the T-account, a customer deposits an additional $60,000 into his account at the bank. If the bank takes no other action it will

A) have $64,000 in excess reserves.

B) have $4,000 in excess reserves.

C) be in a position to make new loans equal to $6,000

D) None of the above is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is correct?<br>A)The Fed

Q19: The federal funds rate is the interest

Q24: Which of the following is correct?<br>A)The Federal

Q27: When we measure and record economic value,we

Q60: The Fed purchases $200 worth of government

Q64: The money multiplier equals<br>A)1/R,where R represents the

Q69: If the reserve requirement is 5 percent,a

Q81: Which of the following is a store

Q121: Scenario 29-2.<br>The Monetary Policy of Tazi is

Q400: Consider five high school students working on