Essay

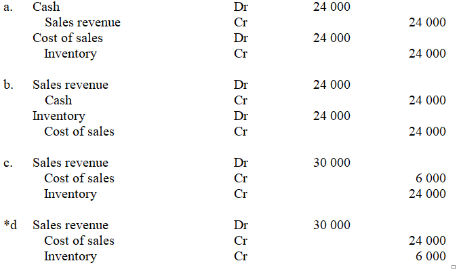

In May 20X7, a parent entity sold inventory to a subsidiary entity for $30 000. The inventory had previously cost the parent entity $24 000. The entire inventory is still held by the subsidiary at reporting date, 30 June 20X7. Ignoring tax effects, the adjustment entry in the consolidation worksheet at reporting date is:

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A Ltd sold an item of plant

Q9: Angelo Limited sold inventory to its parent

Q12: During the year ended 30 June 20X7

Q13: A subsidiary sold inventory to a parent

Q15: A consolidation adjustment entry made to eliminate

Q20: A parent entity group sold a depreciable

Q20: A subsidiary entity sold inventory to a

Q23: The test indicating that an intragroup business

Q24: Equipment costing $10 000 was sold by

Q25: A subsidiary entity sold inventory to its