Multiple Choice

When a state or local government agency receives federal funds, it is subject to the audit requirements of:

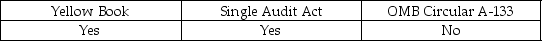

A)

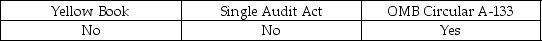

B)

C)

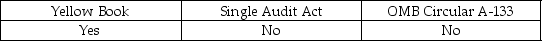

D)

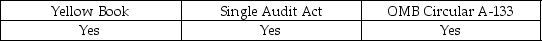

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Which of the following is most correct

Q8: External financial statement auditors must obtain evidence

Q11: Current professional auditing standards allow external auditors

Q14: Which of the following operational audits are

Q28: The two most important qualities for an

Q51: The auditing standards of the Yellow Book

Q64: How do the risk and materiality thresholds

Q69: Which of the following is not a

Q70: Government auditing standards are included in the

Q83: Which of the following best describes an