Multiple Choice

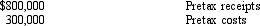

Blue Ridge Resorts has the following pretax information available for the current year:  Assuming all receipts are taxable and all costs are tax-deductible, what will be Blue Ridge's after-tax net income for the year if their tax rate is 30%?

Assuming all receipts are taxable and all costs are tax-deductible, what will be Blue Ridge's after-tax net income for the year if their tax rate is 30%?

A) $330,000

B) $150,000

C) $350,000

D) $770,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Jansen Inc. currently produces and sells 9,000

Q19: You are trying to determine whether machine

Q20: Regression Analysis 2 You run a regression

Q21: Which of the following is most likely

Q22: As production goes up, total fixed costs

Q24: Briefly describe the difference between fixed, variable,

Q25: Jameson Inc. plans to double its rental

Q26: You run a regression analysis and receive

Q27: For each of the following statements, fill

Q28: Which of the following statements is false