Multiple Choice

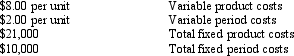

Lockhart Products produces a single product. During 2012 the company incurred the following costs:  Lockhart had no units in beginning inventory. During 2012, 6,000 units were produced and 5,000 units were sold. Which of the following statements is true when comparing net operating income using absorption versus variable costing?

Lockhart had no units in beginning inventory. During 2012, 6,000 units were produced and 5,000 units were sold. Which of the following statements is true when comparing net operating income using absorption versus variable costing?

A) Net operating income will be $3,500 higher using absorption costing than using variable costing.

B) Net operating income will be $3,500 lower using absorption costing than using variable costing.

C) Net operating income will be $4,200 higher using absorption costing than using variable costing.

D) Net operating income will be $4,200 lower using absorption costing than using variable costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: Beauregard Imports has pretax income of $75,000.

Q83: After-tax income can be calculated as follows:<br>A)

Q84: Cornell Products has the following information available

Q85: Which of the following line descriptions would

Q86: The cost equation, y = $500 +

Q88: When using regression analysis to predict mixed

Q89: Pearson Products believes one of its costs

Q90: Putnam Distributors is contemplating whether or not

Q91: Regression analysis is a technique used to:<br>A)

Q92: Quality Products Inc. incurred total costs of