Essay

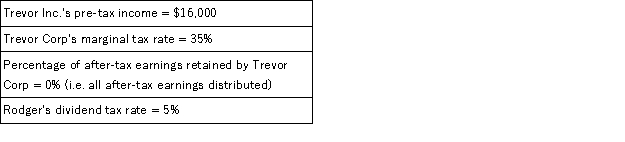

Rodger owns 100% of the shares in Trevor Inc., a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: All unincorporated entities are generally treated as

Q4: From a tax perspective, which entity choice

Q4: From a tax perspective, which entity choice

Q6: Generally, which of the following flow-through entities

Q43: Which of the following legal entities are

Q51: When an employee/shareholder receives an income allocation

Q57: Tuttle Corporation (a C corporation)projects that it

Q59: Taylor would like to organize DRK as

Q79: Roberto and Reagan are both 25 percent

Q87: Corporations are legally better suited for taking