Short Answer

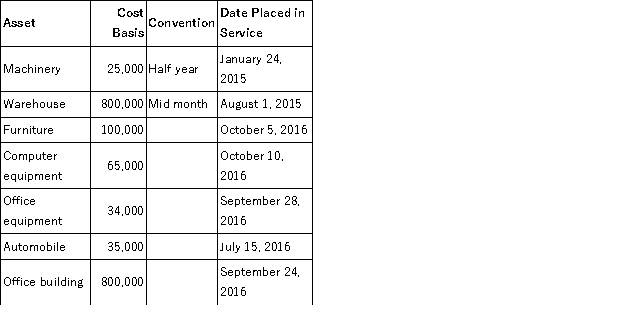

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2015 and 2016:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2015, but would like to elect §179 expense for 2016 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2016, rounded to the nearest whole number (ignore bonus depreciation for 2016). If necessary, use the 2015 luxury automobile limitation amount for 2016 and assume that the 2015 §179 limits are identical to 2016.

Correct Answer:

Verified

$234,787

Explanation: §179 allows expens...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation: §179 allows expens...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: If a business mistakenly claims too little

Q39: Amit purchased two assets during the current

Q49: Jaussi purchased a computer several years ago

Q51: How is the recovery period of an

Q52: Olney LLC only purchased one asset this

Q70: Tax depreciation is currently calculated under what

Q74: Which of the following would be considered

Q80: Occasionally bonus depreciation is used as a

Q90: Tax cost recovery methods do not include:<br>A)

Q105: Assume that Yuri acquires a competitor's assets