Multiple Choice

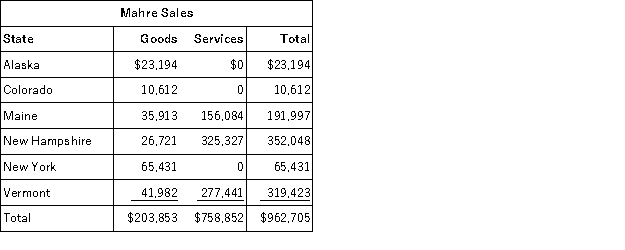

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out of state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:

Assume the following sales tax rates: Alaska (6.6 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

A) $12,190

B) $14,543

C) $26,733

D) $61,289

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Many states are expanding the types of

Q19: Which of the following is not a

Q29: Commercial domicile is the location where a

Q36: Gordon operates the Tennis Pro Shop in

Q43: Gordon operates the Tennis Pro Shop in

Q59: Which of the following states is not

Q69: What was the Supreme Court's holding in

Q110: Which of the following activities will create

Q118: Giving samples and promotional materials without charge

Q139: Business income includes all income earned in