Multiple Choice

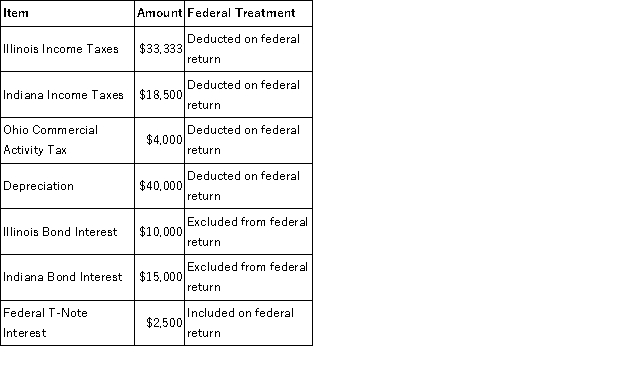

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

State depreciation expense was $50,000. Hoosier's Federal Taxable Income was $150,300. Calculate Hoosier's Illinois state tax base.

A) $171,300

B) $173,800

C) $204,633

D) $207,133

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Interest and dividends are allocated to the

Q14: Most state tax laws adopt the federal

Q41: Which of the following is not one

Q60: Super Sadie,Incorporated manufactures sandals and distributes them

Q62: Roxy operates a dress shop in Arlington,

Q66: Which of the items is correct regarding

Q98: What was the Supreme Court's holding in

Q103: Nondomiciliary businesses are subject to tax everywhere

Q103: What was the Supreme Court's holding in

Q108: Purchases of inventory for resale are typically