Short Answer

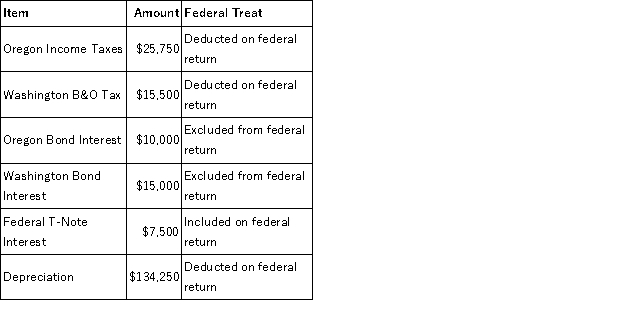

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Correct Answer:

Verified

$571,743.

Explanatio...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanatio...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: List the steps necessary to determine an

Q42: Gordon operates the Tennis Pro Shop in

Q46: Mighty Manny, Incorporated manufactures and services deli

Q58: Tennis Pro is headquartered in Virginia. Assume

Q60: Several states are now moving towards economic

Q74: The primary purpose of state and local

Q76: Wyoming imposes an income tax on corporations.

Q89: A gross receipts tax is subject to

Q103: Nondomiciliary businesses are subject to tax everywhere

Q115: A state's apportionment formula usually relies on