Multiple Choice

On 1 July 2010,Sunday Ltd entered into a 50:50 joint operation with Night Ltd to develop an open cut coal mine in central Queensland.Each operator's initial contribution was $4 million.Sunday contributed $2 million cash and equipment with a fair value of $2 million and a book value of $1 000 000.Night contributed $4 million cash.

Additional information

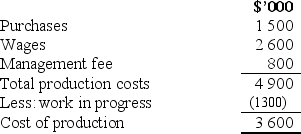

Production costs for the JO for the year ended 30 June 2011 were as follows.

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

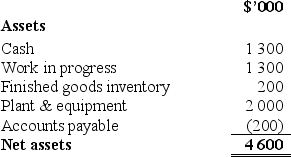

An extract of JO's balance sheet at 30 June 2011 shows:

Which of the following will not form part of Sunday Ltd's initial contribution entry?

A) Debit against the cash in JO account of $3 000 000.

B) Debit against the equipment in JO account of $1 000 000.

C) Credit against the cash of $2 000 000.

D) Credit against the gain on equipment of $500 000.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following statements is incorrect?<br>A)Accounting

Q9: Which of the following statements is incorrect?<br>A)

Q12: On 1 July 2010,Sunday Ltd entered

Q13: If the joint arrangement is not structured

Q14: Which of the following statements is incorrect?<br>A)

Q14: On 1 July 2010,Sunday Ltd entered

Q15: According to AASB 11 Joint Arrangements,joint control

Q16: Which of the following statements is not

Q24: A joint operation holds equipment with a

Q26: Three joint operators are involved in a