Multiple Choice

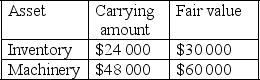

On 1 July 2016 Titans Ltd acquired a 25% share of Taylor Ltd.At that date,the following assets had carrying amounts different to their fair values in Taylor's books.

All inventory was sold to third parties by 30 June 2017.On 1 July 2016,the machinery had a remaining useful life of 3 years.

The tax rate is 30%.

The adjustment required to the investment in associate account at 30 June 2017 in relation to the above assets is:

A) $1750.

B) $2500.

C) $7000.

D) $10 000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The accounting method applied to investments in

Q4: Kanga Limited acquired a 35% investment in

Q6: Significant influence automatically arises where the investor

Q9: Which of the following is not one

Q13: Which of the following are regarded

Q16: Warriors Limited acquired a 20% share in

Q19: Where an entity prepares consolidated financial statements

Q20: On 1 July 2016 Titans Ltd acquired

Q33: The classification of an investment as an

Q34: The holding of debentures by an investor