Multiple Choice

In May 2014,a parent sold inventory to a subsidiary entity for $60 000.The inventory had previously cost the parent entity $48 000.The entire inventory is still held by the subsidiary at reporting date,30 June 2014.Ignoring tax effects,which of the following is the adjustment entry in the consolidation worksheet at reporting date?

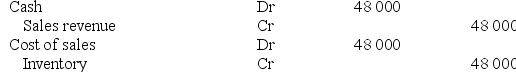

A)

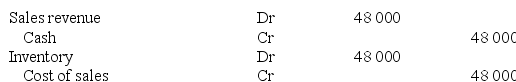

B)

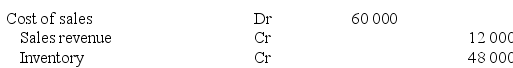

C)

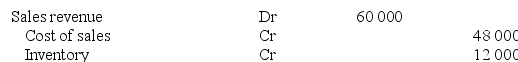

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A parent entity sold a depreciable non-current

Q10: Which of the following items is an

Q13: Adam Ltd sold an item of plant

Q16: When a depreciable non-current asset is sold

Q32: Knights Ltd purchased inventory from its subsidiary,Gidley

Q34: Which of the following intragroup transactions do

Q37: The effect of an intragroup sale of

Q38: The effect of an intragroup sale of

Q40: The effect of an intragroup sale of

Q41: A subsidiary sold inventory to its parent