Multiple Choice

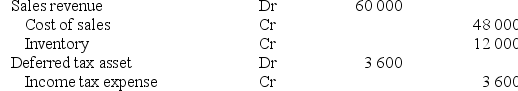

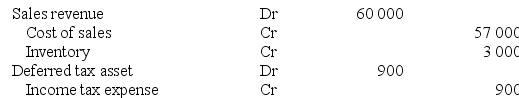

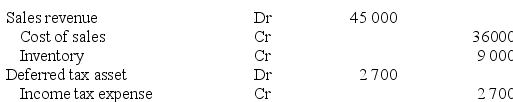

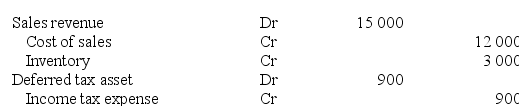

A subsidiary sold inventory to its parent for $60 000.The inventory had previously cost the subsidiary $48 000.By reporting date,the parent had sold 75% of the inventory to a party outside the group.The company tax rate is 30%.Which of the following are the adjustment entries in the consolidation worksheet at reporting date?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A subsidiary sold inventory to its parent

Q5: A subsidiary sold inventory to its parent

Q6: Unrealised profit in the opening inventory of

Q7: The effect of an intragroup sale of

Q13: Where an intragroup sale of an asset

Q14: A subsidiary sold a quantity of inventory

Q23: When an interest bearing loan is advanced

Q37: When a depreciable non-current asset is sold

Q42: If an interim dividend is paid by

Q45: When a non-depreciable non-current asset such as