Multiple Choice

Assume that on September 1, 2016, a 6-month rent payment for $12,000 per month (for a total of $72,000) was made with respect to a commercial lease that the company entered into on that date as a tenant. The company took occupancy of the rented space immediately. The lease term will expire on February 28, 2017. The $72,000 payment was recorded as a debit to Prepaid Rent on September 1, 2016. The adjusting entry on December 31, 2016, is as follows:

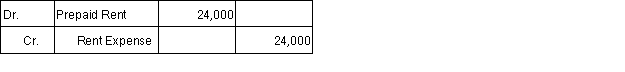

A)

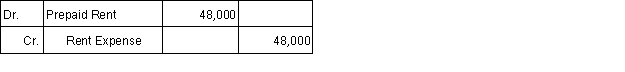

B)

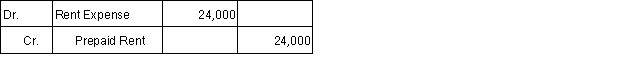

C)

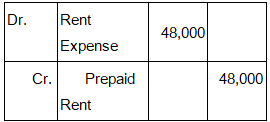

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The amount of cash related to a

Q11: The balance sheet valuation of inventories is:<br>A)lower

Q18: The balance sheet presentation of accounts receivable

Q19: Prepaid expenses classified as current assets represent:<br>A)

Q21: Which of the following is NOT an

Q23: The principal reason for converting a customer's

Q25: An accounts receivable results from the sale

Q26: A firm has used LIFO for several

Q27: Which of the following inventory accounting systems

Q29: One of the principal reasons for selecting