Multiple Choice

To accrue $3,200 of employee salaries for the last week of February, the employer's journal entry is:

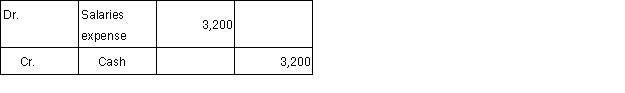

A)

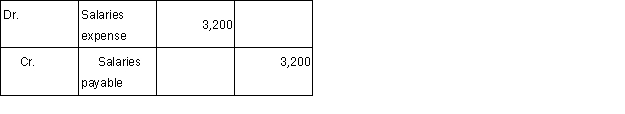

B)

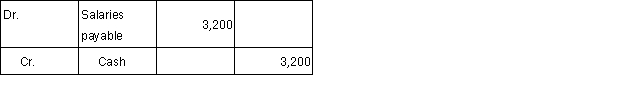

C)

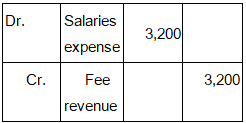

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: A debit entry will:<br>A)always decrease the account

Q18: When a firm purchases supplies for use

Q20: Using the column headings provided below, show

Q21: The Interest Receivable account for February showed

Q23: A journal entry recording an accrual:<br>A) results

Q24: An engineering consultant provided $300 of services

Q24: A newspaper ad submitted and published this

Q29: The accounting concept/principle being applied when an

Q30: In an advertiser's records, a newspaper ad

Q35: The effect of an adjustment on the