Essay

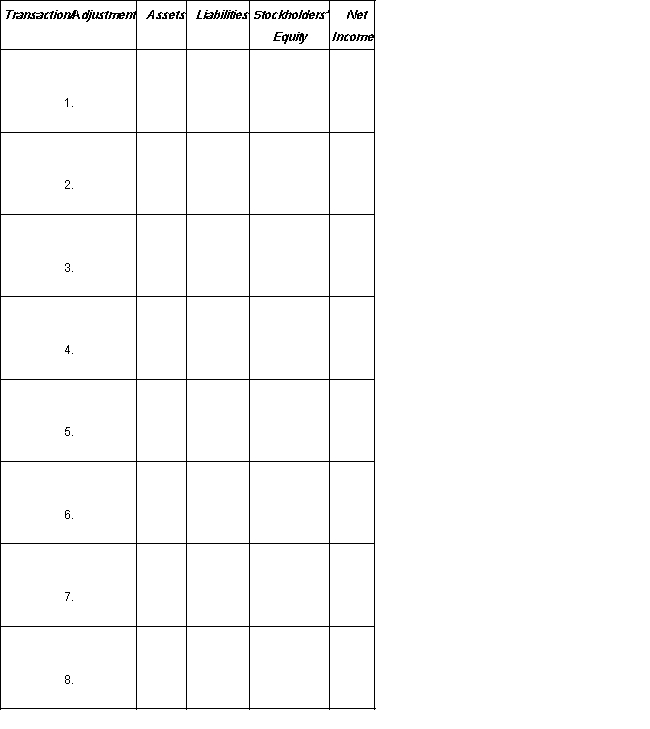

Using the column headings provided below, show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the account name, amount, and indicating whether it is an addition (+) or subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity.(1.) During the month, the board of directors declared a cash dividend of $2,400, payable next month.(2.) Employees were paid $3,800 in wages for their work during the first three weeks of the month.(3.) Employee wages of $1,200 for the last week of the month have not been recorded.(4.) Merchandise that cost $1,800 was sold for $2,700. Of this amount, $2,000 was received in cash and the balance is expected to be received within 30 days.(5.) A contract was signed with a local radio station for a $200 advertisement; the ad was aired during this month but will not be paid for until next month.(6.) Store equipment was purchased at a cash price of $600. The original list price of the equipment was $800, but a discount was received.(7.) Received $360 of interest income for the current month.(8.) Accrued $620 of interest expense at the end of the month.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A debit entry will:<br>A)always decrease the account

Q13: A journal:<br>A)is where transactions are initially recorded.<br>B)is

Q19: A credit entry will:<br>A)always decrease the account

Q23: A journal entry recording an accrual:<br>A) results

Q24: A newspaper ad submitted and published this

Q24: An engineering consultant provided $300 of services

Q29: Martin & Associates borrowed $15,000 on April

Q31: Martin & Associates borrowed $15,000 on April

Q33: Wisdom Co.has a note payable to its

Q35: The effect of an adjustment on the