Essay

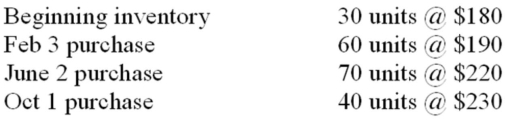

Stewart Company sold 180 units @ $320 each on October 31,2012.Cash selling and administrative expenses were $15,000.The following information is also available:  The company's income tax rate is 40%.

The company's income tax rate is 40%.

Required:

a)Determine the amount of cost of goods sold using:

FIFO

LIFO

Weighted Average

b)Determine the amount of ending inventory using:

FIFO

LIFO

Weighted Average

c)Determine the company's net income (after income taxes)using:

FIFO

LIFO

Correct Answer:

Verified

a)Cost of Goods Sold

b)FIFO ...

b)FIFO ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: A promissory note may be secured by

Q26: The amount of uncollectible accounts expense recognized

Q27: Haltom Co.uses the allowance method to account

Q28: The following information is available for Parsons

Q32: The following information is for Carmen Company

Q33: On March 31,2012,Stuart Co.wrote off a $600

Q34: On October 1,2012,Balkan,Inc.accepted from another corporation a

Q35: Which of the following answers correctly states

Q36: On November 1,2012,Hardin Company accepted a credit

Q84: When a customer's account,previously written off as