Essay

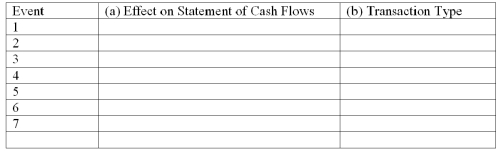

The following transactions apply to Fort Bend Corporation:

1)Issued common stock for $21,000 cash

2)Provided services to customers for $28,000 on account

3)Purchased land for $18,000 cash

4)Incurred $9,000 of operating expenses on credit

5)Collected $15,000 cash from customers

6)Paid $7,000 on accounts payable

7)Paid $2,500 dividends to stockholders

Required:

a)Identify the effect on the Statement of Cash Flows,if any,for each of the above transactions.Indicate whether each transaction involves operating,investing,or financing activities and the amount of increase or decrease.

b)Classify the above accounting events into one of four types of transactions (asset source,asset use,asset exchange,claims exchange).

Correct Answer:

Verified

Correct Answer:

Verified

Q10: What type of account is Unearned Revenue?

Q11: The amounts of revenue that would appear

Q12: At the end of the accounting period,Sefcik

Q13: Which of the following accounts is a

Q14: Bloomfield Company issued stock for $30,000 cash

Q16: Grace's net income was:<br>A) $200.<br>B) $350.<br>C) $3,050.<br>D)

Q17: Meyer Co.,in its first year of operations,purchased

Q18: Which of the following would be included

Q19: Remsen Co.incurred $700 of expenses on account.

Q20: Stahl Company paid $7,800 on May 1,2012