Essay

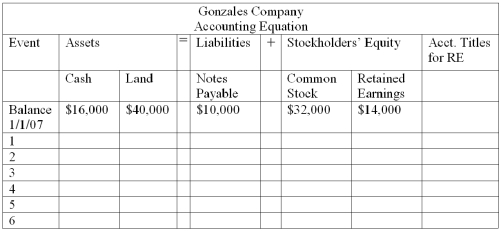

At the beginning of the year,Gonzales Company's accounting records had the general ledger accounts and balances shown in the table below.During the year,the following transactions occurred:

1.received $80,000 cash for providing services to customers

2.paid rent expense,$10,000

3.purchased land for $9,000 cash

4.paid $5,000 on note payable

5.paid operating expenses,$52,000

6.paid cash dividend,$6,000

Required:

a)Record the transactions in the appropriate general ledger accounts.Record the amounts of revenue,expense,and dividends in the Retained Earnings column,providing appropriate titles for these accounts in the last column of the table.  b)What is the amount of total assets as of the end of the year?

b)What is the amount of total assets as of the end of the year?

c)What is the amount of total stockholders' equity as of the end of the year?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Assuming that Hardin engaged in no transactions

Q2: Ling Corporation paid a $3,000 cash dividend

Q4: Dare Company paid $5,000 to one of

Q5: Bond Company experienced an accounting event that

Q6: Which of the following items would appear

Q7: Wave Company borrowed $10,000 cash from a

Q8: The following transactions apply to Copeland's Fitness

Q9: Taos Corporation earned cash revenues of $52,000.

Q10: A stockholder in a corporation would use

Q11: During the year,STU Company earned $6,000 of