Multiple Choice

Consider the following to answer the question(s) below:

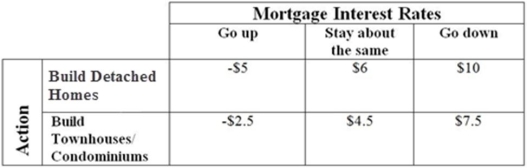

A landowner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

-Suppose housing analysts predict that the probabilities for future mortgage interest rates going up, staying about the same, and going down are 0.35, 0.50 and 0.15, respectively. The expected value for building detached homes in a planned retirement community is

A) $2.5 million.

B) $3.625 million.

C) $2.75 million.

D) $875,000.

E) $46.25 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Consider the following to answer the question(s)

Q10: Consider the following to answer the question(s)

Q12: Consider the following to answer the question(s)

Q13: Consider the following to answer the question(s)

Q14: Consider the following to answer the question(s)

Q16: Consider the following to answer the question(s)

Q17: Consider the following to answer the question(s)

Q18: Consider the following to answer the question(s)

Q19: Consider the following to answer the question(s)

Q20: Consider the following to answer the question(s)