Multiple Choice

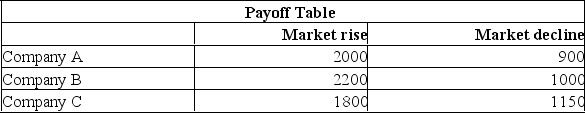

You are trying to decide in which of the three companies you should invest. Refer to the following Payoff Table.  If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

If the probability of the market declining in the next year is 0.5, which of the following statements are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

A) (i) , (ii) , and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii) .

C) (ii) is a correct statement but not (i) or (iii) .

D) (iii) is a correct statement but not (i) or (ii) .

E) (i) , (ii) , and (iii) are all false statements.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: You have a decision to invest $10,000

Q21: The alternative which offers the lowest EOL

Q22: Determine the expected profit for the following

Q23: Suppose that the below represents the opportunity

Q24: Given the following decision table in which

Q26: A decision tree:<br>A) uses a box to

Q27: i. EVPI = Expected value under conditions

Q28: You have a decision to invest $10,000

Q29: You are trying to decide in which

Q30: You are trying to decide in which