Multiple Choice

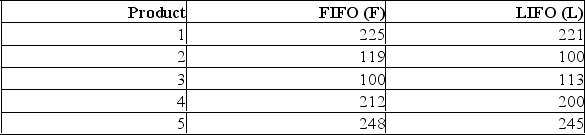

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

If you use the 5% level of significance, what is the critical t value?

A) +2.571

B) 2.776

C) +2.262

D) 2.228

E) +2.132

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Accounting procedures allow a business to

Q62: Married women are more often than not

Q63: To compare the effect of weather

Q64: Married women are more often than

Q65: A recent study compared the time spent

Q67: To compare the effect of weather on

Q68: An investigation of the effectiveness of a

Q69: The employees at the East Vancouver

Q70: Suppose we test H0: <span

Q71: A national manufacturer of ball bearings is