Multiple Choice

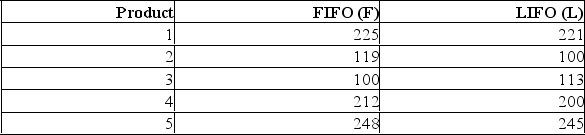

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Fail to reject the null hypothesis and conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective.

D) Fail to reject the null hypothesis and conclude LIFO is not more effective.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Married women are more often than not

Q35: An investigation of the effectiveness of a

Q36: The employees at the East Vancouver

Q37: i. If samples taken from two populations

Q38: i. If we are testing for the

Q40: Of 150 adults who tried a new

Q41: A company is researching the effectiveness of

Q42: A national manufacturer of ball bearings

Q43: Using two independent samples, two population means

Q44: To compare the effect of weather