Multiple Choice

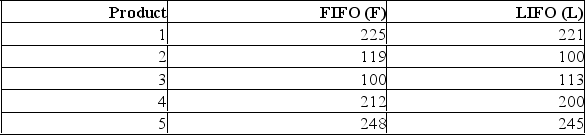

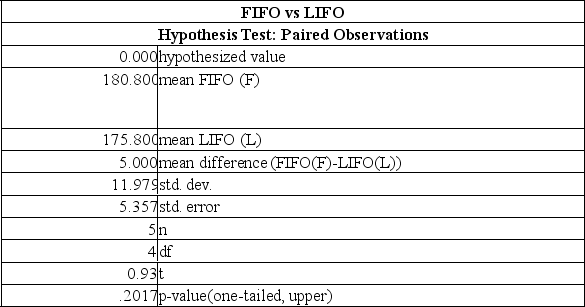

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Looking at the large P-value of.2019 we conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective.

D) The large P-value of.2017 indicates that there is a good chance of getting this sample data when the two methods are in fact not significantly different, so we conclude that LIFO is not more effective.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: i. If the null hypothesis states that

Q17: A national manufacturer of ball bearings is

Q18: A company is researching the effectiveness

Q19: Accounting procedures allow a business to

Q20: Accounting procedures allow a business to evaluate

Q22: To compare the effect of weather

Q23: i. The paired difference test has (n<sub>1</sub><sub>

Q24: Accounting procedures allow a business to evaluate

Q25: Of 150 adults who tried a new

Q26: A recent study compared the time spent