Essay

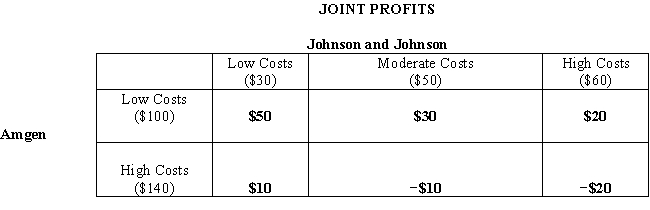

What are the expected net profits to Johnson & Johnson in a pharmaceutical R&D joint venture with Amgen given the following joint profit payoffs.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.Assume that the three columns are equally likely to occur,each row is equally likely to occur.Both Johnson and Johnson and Amgen can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.  The figures in parentheses represent costs associated with the Low,Moderate and High cost realizations,and all figures are in millions.

The figures in parentheses represent costs associated with the Low,Moderate and High cost realizations,and all figures are in millions.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Appendix: An incentive-compatible revelation mechanism is<br>A) self-enforcing<br>B)

Q7: Appendix:<br>Refer to Exhibit 15A-1.<br><br>Part C: What is

Q8: Appendix: Common value auctions with open bidding

Q9: Buying electricity off the freewheeling grid at

Q10: Agency problems appear in many settings within

Q12: Which of the following are not approaches

Q13: When someone contracts to do a task

Q14: Appendix: A Dutch auction implies all of

Q15: Appendix: An incentive-compatible mechanism for revealing true

Q16: Refer to Exhibit 15A-1.<br>Part B: What are