Multiple Choice

-If a unit excise tax is placed on a good for which the demand is very unresponsive to a price change, then

A) the government generally pays the majority of the tax.

B) the consumers generally pay the majority of the tax.

C) the producers generally pay the majority of the tax.

D) producers and consumers pay equal portions of the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: How is the market for gasoline affected

Q61: Social Security taxes are<br>A) progressive because all

Q62: A unit tax<br>A) is based on the

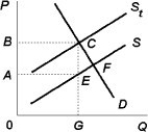

Q63: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Refer to the

Q64: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Assume that the

Q66: A unit tax of $1 will always<br>A)

Q67: The imposition of a tax on a

Q68: Dynamic tax analysis assumes<br>A) all of the

Q69: Suppose Jill has earned more income this

Q70: A government is thinking about increasing the