Essay

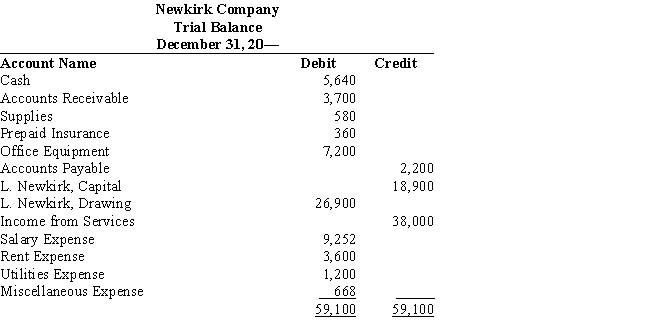

Newkirk Company began operations on January 1. The trial balance as of December 31 is presented below.

Data for the adjustments are as follows:

a.The office equipment has a life of five years with an estimated trade-in value of $600 at the end of five years.

b.Weekly wages amount to $180 for a five-day week. As of December 31, three days' wages have accrued.

c.Prepaid Insurance represents a twelve-month policy beginning March 1 of the year.

d.Supplies used during December, $215.

Instructions:

Record the adjusting entries for Newkirk Company in general journal form.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Failure to record the adjusting entry for

Q17: If the adjustment for accrued wages is

Q18: The adjusted trial balance debit column of

Q19: Sunny Day Company has $740 of

Q20: A company produced a net income of

Q22: The adjusting entry to record depreciation of

Q23: Which of the following accounts is not

Q24: Net income for Susan's Treasures is $25,000

Q25: Assuming a normal balance, which of the

Q26: If total credits exceed total debits in