Multiple Choice

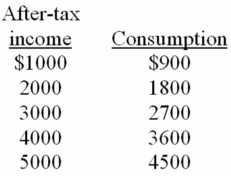

-The above data suggest that:

A) a policy of tax reduction will increase consumption.

B) a policy of tax increases will increase consumption.

C) tax changes will have no impact on consumption.

D) after-tax income should be lowered to increase consumption.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When an economist says that material wants

Q109: The concept of opportunity cost<br>A) is irrelevant

Q129: When an economy is operating with maximum

Q211: Unemployment and/or productive inefficiencies:<br>A)cause the production possibilities

Q230: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -The linear equation

Q232: Assume that a change in government policy

Q233: (The following economy produces two products. )<br>Production

Q234: Which of the following would be most

Q235: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2474/.jpg" alt=" -Refer to the

Q249: The study of economics exists because:<br>A)government interferes