Essay

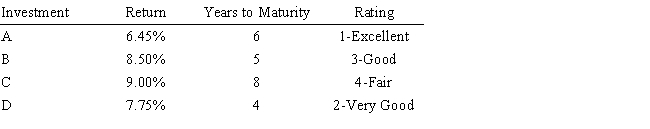

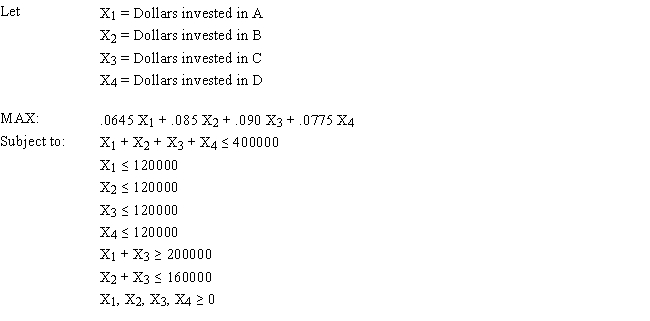

A financial planner wants to design a portfolio of investments for a client. The client has $400,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 30% of the money in any one investment, at least one half should be invested in long-term bonds which mature in six or more years, and no more than 40% of the total money should be invested in B or C since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

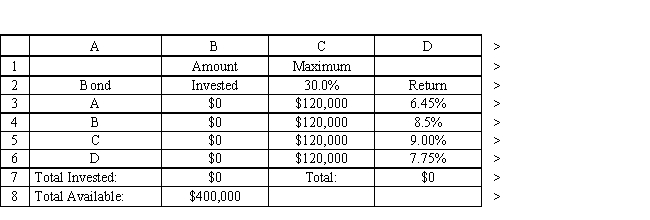

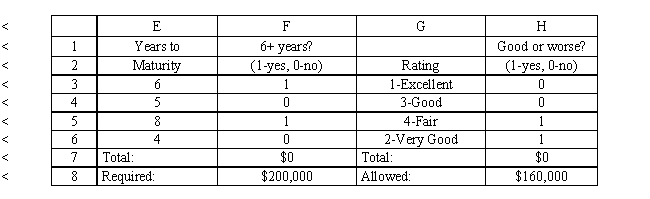

What values would you enter in the Analytic Solver Platform (ASP) task pane for the following cells for this Excel spreadsheet implementation of this problem?

What values would you enter in the Analytic Solver Platform (ASP) task pane for the following cells for this Excel spreadsheet implementation of this problem?

Objective Cell:

Variables Cells:

Constraints Cells:

Correct Answer:

Verified

Correct Answer:

Verified

Q80: A company is planning production for the

Q81: The "Objective Value of" option in the

Q82: Exhibit 3.2<br>The following questions are based on

Q83: Scaling problems<br>A) can cause Analytic Solver Platform

Q84: Decision variables are sometimes referred to as

Q86: How many decision variables are there in

Q87: Which type of spreadsheet cell represents the

Q88: A financial planner wants to design a

Q89: Bounds on the decision variables are known

Q90: You have been given the following linear