Short Answer

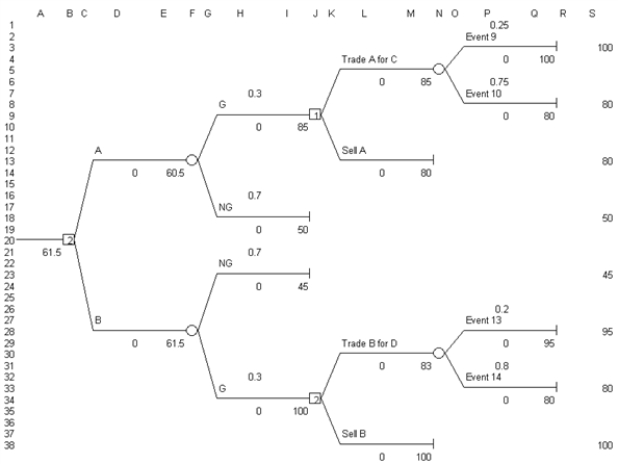

Exhibit 14.14

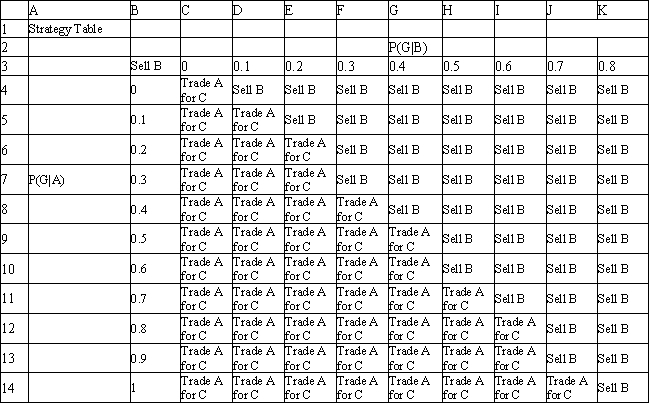

The following questions use the Decision Tree model and strategy table information below.

-An investor is considering 2 investments, A, B, which can be purchased now for $10. There is a 40% chance that investment A will grow rapidly in value and a 60% chance that it will grow slowly. If A grows rapidly the investor can cash it in for $80 or trade it for investment C which has a 25% chance of growing to $100 and a 75% chance of reaching $80. If A grows slowly it is sold for $50. There is a 70% chance that investment B will grow rapidly in value and a 30% chance that it will grow slowly. If B grows rapidly the investor can cash it in for $100 or trade it for investment D which has a 20% chance of growing to $95 and an 80% chance of reaching $80. If B grows slowly it is sold for $45. What is the multistage decision for this investor and what is the EMV for this decision?

Correct Answer:

Verified

Pick B, Se...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Exhibit 14.5<br>The following questions are based on

Q99: The expected monetary value decision rule selects

Q100: Exhibit 14.5<br>The following questions are based on

Q101: Exhibit 14.7<br>The following questions use the information

Q102: Exhibit 14.13<br>The following questions use the information

Q104: Exhibit 14.8<br>The following questions use the information

Q105: Exhibit 14.10<br>The following questions are based on

Q106: Exhibit 14.9<br>The following questions are based on

Q107: Exhibit 14.6<br>The following questions use the information

Q108: Exhibit 14.5<br>The following questions are based on