Multiple Choice

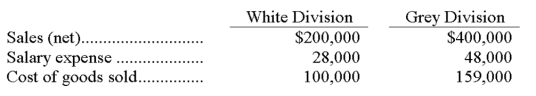

Jamesway Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the White and Grey Divisions, respectively.

The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the White and Grey Divisions, respectively.

A) $72,000; $193,000.

B) $172,000; $352,000.

C) $100,000; $241,000.

D) $52,000; $163,000.

E) $72,000; $163,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A department's direct expenses can be entirely

Q7: Yoho Company reported the following financial numbers

Q24: Data pertaining to a company's joint production

Q27: The following data is available for the

Q28: Baker Corporation has two operating departments, Machining

Q34: A factor that causes the cost of

Q36: Investment center is another name for profit

Q64: Belgrade Lakes Properties is developing a golf

Q76: Activity based costing can be applied to:<br>A)

Q101: The most useful allocation basis for the