Multiple Choice

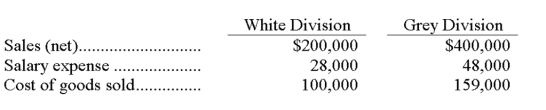

Jamesway Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the White and Grey Divisions, respectively.

The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the White and Grey Divisions, respectively.

A) $52,000; $163,000.

B) $172,000; $352,000.

C) $72,000; $163,000.

D) $72,000; $193,000.

E) $100,000; $241,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: An activity-based cost allocation system:<br>A) Is one

Q56: Why would a firm use activity-based costing

Q80: Eleanor Reed, the manager of the Marinette

Q82: Renton Co. has two operating (production) departments

Q86: Dresden, Inc. has four departments. Information about

Q88: Traditional two-stage cost allocation means that indirect

Q132: Describe the information found on a responsibility

Q138: For an investment center, the hurdle rate

Q141: A responsibility accounting performance report reports:<br>A) Only

Q148: A department that is responsible for maximizing