Not Answered

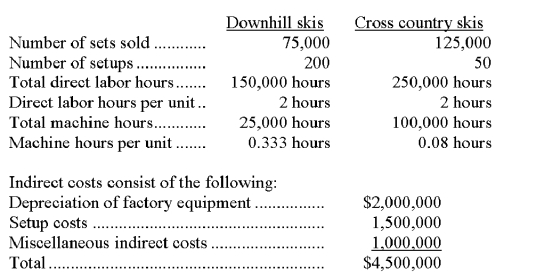

Outdoor Sports, Inc., produces two types of skis, downhill skis and cross country skis. Product and production information about the two items is shown below:  Required:

Required:

1. If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Outdoor Sports uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

Correct Answer:

Verified

Correct Answer:

Verified

Q68: A company pays $15,000 per period to

Q94: A company rents a building with a

Q95: Mach Co. operates three production departments as

Q95: The most useful evaluation of a manager's

Q101: A retail store has three departments, 1,

Q103: An activity-based costing system usually involves a

Q103: Larabee Company produces two types of product,

Q125: What is the primary purpose for using

Q150: In producing oat bran, the joint cost

Q172: Abbe Company reported the following financial numbers