Not Answered

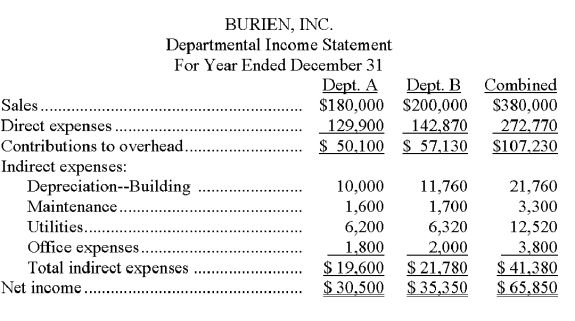

Burien, Inc., operates a retail store with two departments, A and

B. Its departmental income statement for the current year follows:

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

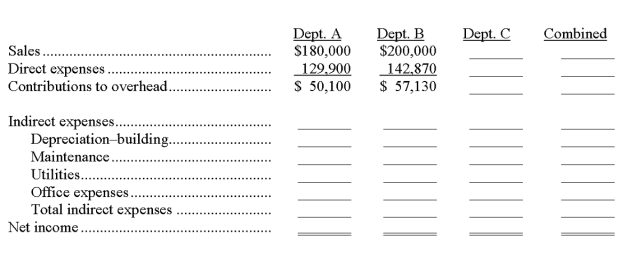

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Yoho Company reported the following financial numbers

Q16: The following is a partially completed lower

Q34: A factor that causes the cost of

Q37: The amount by which a department's revenues

Q40: Describe the two-stage allocation of overhead costs.

Q82: Departmental contribution to overhead is the same

Q83: A responsibility accounting system:<br>A) Is designed to

Q101: The most useful allocation basis for the

Q137: Generally, it does not matter how cost

Q142: A unit of a business that not