Not Answered

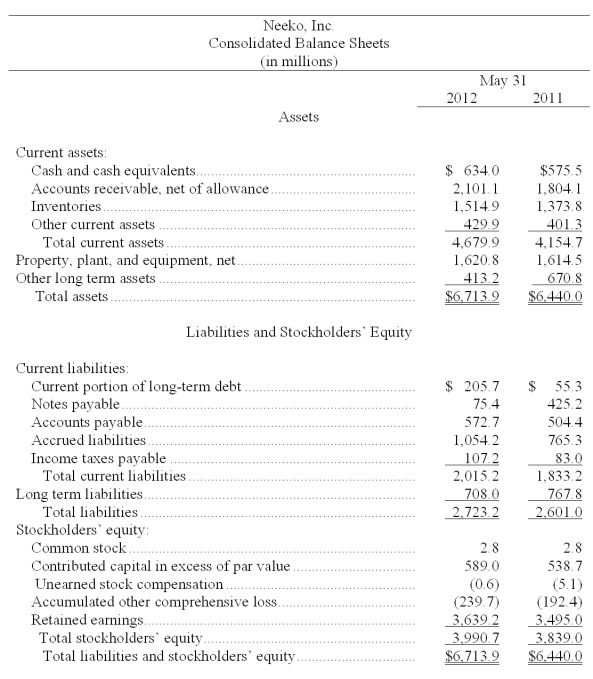

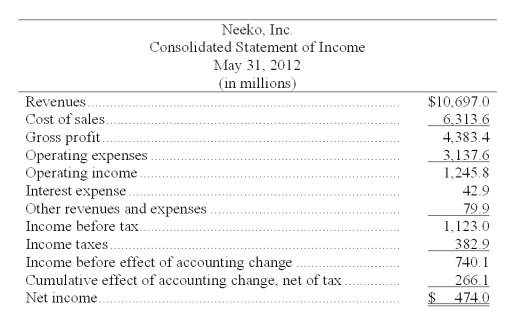

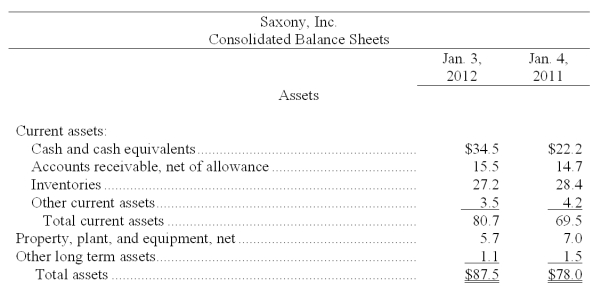

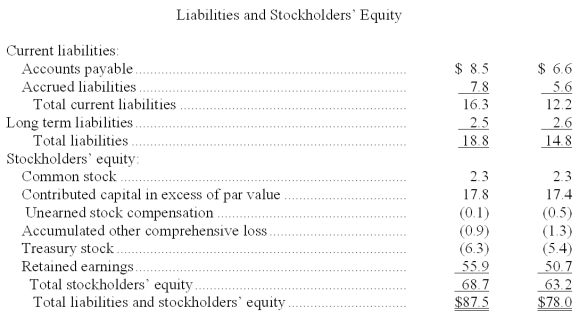

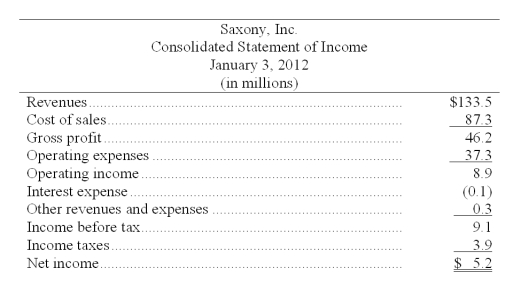

The following summaries from the income statements and balance sheets of Neeko, Inc. and Saxony, Inc. are presented below.

(1) For both companies for 2012, compute the

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies for 2012, compute the

(a) Profit margin ratio

(b) Return on total assets

(c) Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The measurement of key relationships between financial

Q10: The following selected financial information for a

Q16: Refer to the following selected financial information

Q30: One of several ratios that reflects solvency

Q32: The current ratio is calculated as current

Q56: Phoenix Company reported sales of $400,000 for

Q115: Measures taken from a selected competitor or

Q151: The evaluation of company performance and financial

Q196: A company's sales in Year 1 were

Q219: The comparison of a company's financial condition